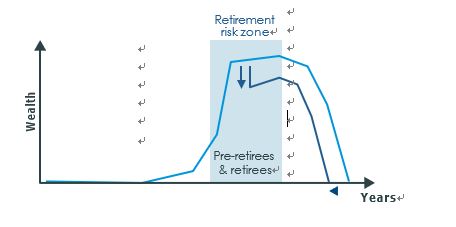

There is probably no other time when your financial wellbeing is at risk to a sudden decline in value of your nest egg – simply because it’s at its peak balance. This is known as sequencing risk. A 5% decline in equity markets during this zone is not uncommon, and it can have a huge impact and shave years off a retirement portfolio, simply due to bad timing. Put it this way, it’s worse having a bad performing year when you have more money, than when you have less.

This period is shown in the chart to the right.

It is during the years in this retirement risk zone that financial advice offers its greatest value.

And this period demonstrates why portfolio strategy for retirees is more about protecting capital as much as possible (and that still means investing in equities), and less about shooting the lights out with total return performance.

How do you get your equities?

There seems to be three broad camps when it comes equity investing:

- Direct equities

- Accumulation strategies

- Equity income

Direct equities

A direct holding means an investor holds shares in their own name, most likely via a broker or even a Separately Managed Account.

Accumulation strategies

(active or index funds)

The accumulation strategy describes traditional Australian equity approaches designed for pre-retirees that seek to maximise total return and capital growth. In pursuit of wealth, accumulation investors are generally happy to accept a reasonable level of risk volatility in their capital, because they have time to recover and wages can help top up any shortfall.

Even a strong performing accumulation equity fund can still be highly volatile.

And it may not provide adequate refuge from sequencing risk during a decline when it hurts most – the retirement risk zone years when a super balance is highest.

Equity Income

Equity income funds are designed to provide a lower level of risk than accumulation strategies and provide a higher amount of their return as dividend income. Generally, you would expect an equity income to have lower capital volatility than an accumulation fund, and higher income at the same time.

The trade-off is that equity income funds tend to have lower long-term capital growth potential.

Source: Challenger

.png)